In the ancient times, there was a period when barter system was used. Then, at the beginning of the modern world, paper money was used on a large scale. Now, we have plastic money. Plastic money comprises of the various ATM cards which people carry which belongs to various banks. People use these cards at ATM machines to withdraw cash, obtain account information, carry out other transactions. However, not many people know exactly what an ATM card is or what they can do with it. Also, ATM cards are highly vulnerable to various kinds of hacks and scams which not many people know about. Hence, here we are going to discuss what an ATM card is, and how it works. We will also inform you about the hacking tricks which hackers use to hack your ATM card and make undue use of it. So let’s start by understanding what an atm card is! We are in 2020, A Well famous century for its ‘Security‘ and technology itself. But There are still many loopholes that companies need to know about. Indeed, The Device that we take in uses every day for Deposit and Withdrawal one of the most valuable things i.e “MONEY”. Yeah! Money can buy anything. What else if somebody transfers your money to their bank accounts??? Well, earlier we have discussed some serious security flaws in PayTM and other Indian wallets. ATM is Something that I personally wanted to study on. However, not many people know exactly what an ATM card Wiki is or what they can do with it. Also, ATM cards are highly vulnerable to various kinds of hacks and scams which not many people know about. Hence, here we are going to discuss what an ATM card is, and how it works. We will also inform you about the hacking tricks which hackers use to hack your ATM card and make undue use of it. So let’s start by understanding what an atm card is! An ATM card is a payment card provided by a financial institution to its customers. ATM cards are known by a variety of names such as bank card, money access card (MAC), client card, key card or cash card, etc. Along with ATM cards, other cards such as debit and credit cards are also available for users to use as an alternate. These debit and credit cards have their own unique features but, we will stick to ATM cards only for now.

How does an ATM Card Work? [Debit/Credit]

When you insert your ATM card into the ATM machine, it scans the magnetic strip on the back of the card to read the information encoded on it. That black strip which gets scanned is encoded with your unique card number, expiration date and PIN (personal identification number).

1 How does an ATM Card Work? [Debit/Credit]2 How Does Black Coloured Magnetic Chip Works in Your ATM Card?3 How do Hackers Hack your ATM Card Password?4 How To Secure Your ATM Cards?

The ATM then asks for your PIN to verify your authorization to make changes in your account. Once your PIN is verified, the ATM coordinates with your bank to access your account information. It then allows you to view your account balance or provide cash to you using the ATM machine from your account balance in the bank.

How Does Black Coloured Magnetic Chip Works in Your ATM Card?

Black stripe on the back is filled with bank account data about your account, from the customer name of the card (VISA/MASTERCARD) issuer to the limits on your card. This data is arranged on the stripe using tiny magnetic particles, so prolonged exposure to an external magnet can throw the information out of place and render the card unreadable. “If you disturb the way that the particles were aligned in the first place by putting a magnet close to it, it will disrupt that encoding, and hence your card may damage.

How do Hackers Hack your ATM Card Password?

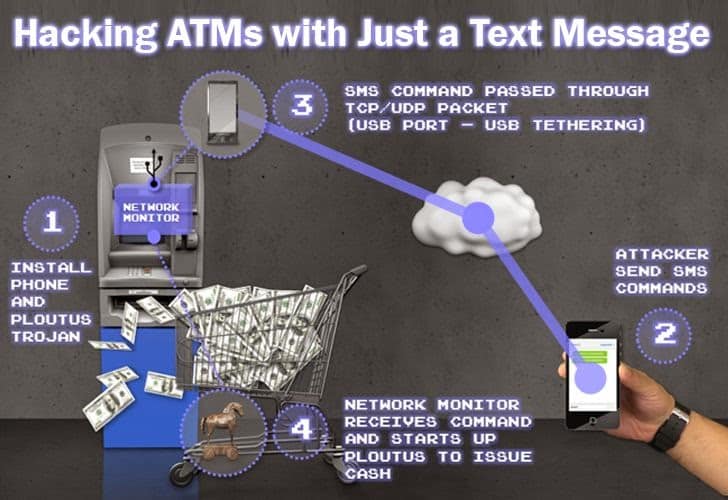

Three ways are using which hackers can hack your ATM card, which is Packet sniffing, and session hijacking, and Social Engineering. Since these ATM cards carry out its processes online, they are highly vulnerable and can be hacked by professional hackers by following simple methods. NOTE: Please note that this tutorial is just for educational purposes. Hacking ATM cards is an illegal activity and will result in serious consequences, such as imprisonment. We are providing this information to let the people know what they have to protect themselves from! The very basic step for a hacker is to become the ‘Man-in-the-Middle‘ between your ATM machine and the internet. Then, the hacker will enable DNS Spoofing via DNSSpoof and turn on the utility to be the ‘Man-in-the-Middle‘ for web sessions via the website. Now, the hacker is all set to do the job. All he needs to do is begin sniffing your data from the ATM machine which include your login and ATM card details. This can be done using Ethereal. Most of the job is done by now! The only thing left for the hacker to do is to decrypt the 128-bit SSL which can again be done using SSL Dump. The Cat command displays all the decrypted data which the hacker had extracted from the ATM machine. Using these techniques, a hacker can log into your online bank account with the same access and privileges as you. This means that the hacker can transfer money, view account data, make use of all the features reserved for you.

How To Secure Your ATM Cards?

Well, Our purpose is not to teach you, How-To Hack, as Security is our very first priority. So Here are some basic points that you have to keep in mind before Paying Online or Logging your Account Online. Meanwhile, Check out these 7 Security Tips For Safer Online Internet Banking Login? #1. Never Share your PIN, Password with anyone (Not even with your closest one, Because Hunger of Money can even change your PARTNERs) #2 Never go with Payment in those sites that are not starting with “HTTPS://” protocol. #3 If you get a new Credit card, make sure to destroy your old one. Make sure to cut the magnetic strip and destroy the old Card chip. #4 Never Share your any BANK Account, ATM Card Number details to anybody in call or message whosoever claim himself as a Bank Representative. No BANK Officials will ask any of your CARD details ever. Wrap Up: This is all you need to know about ATM cards, how they work and how the hackers hack your ATM cards and use it to fulfill their needs. To prevent any such misuse of your account, you must regularly check with your bank regarding the transactions and other details. Did you find this article to be useful? Let us know about it in the comments section below.